Base Metals

Ivanhoe Mines advances key Southern Africa projects

Ivanhoe recorded a profit of $108 million for Q3 2024, matching the profit for Q3 2023. Normalised profit for Q3 2024 was $112million, up from $95 million in Q3 2023.

Key projects and milestones

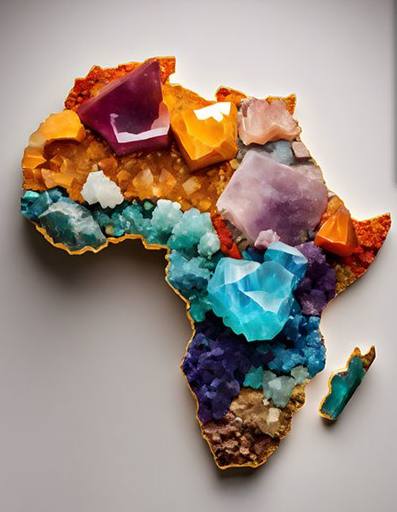

Ivanhoe Mines is focusing on expanding production at the Kamoa-Kakula Copper Complex and ramping up the Kipushi zinc-copper-lead-germanium mine in the Democratic Republic of Congo (DRC). Additionally, the company is building the tier-one Platreef project in South Africa and advancing exploration licenses at the Western Forelands project, which hosts the Makoko, Kitoko, and Kiala copper discoveries near Kamoa-Kakula.

Founder and Co-Chairman Robert Friedland highlighted, “Kamoa-Kakula has reached a major milestone with the ramp-up of the Phase 3 expansion. Phase 3 provides steady-state milling capacity of 600,000 tonnes of copper per annum. We have reached the top tier of the world’s most significant copper complexes, which at every phase were delivered ahead of schedule … a true rarity in our industry.”

Friedland added, “Africa’s largest and greenest copper smelter is nearing construction completion this year.

The smelter will reduce cash costs and improve profitability. With capital expenditures largely behind us at Kamoa-Kakula, we look forward to a period of strong profit and free cash flow, even as we continue to advance further copper growth initiatives on the joint venture.”

Highlights

Cost of Sales: The cost of sales per pound of payable copper sold was $1.80 for Q3 2024, compared to $1.53 and $1.34 in previous quarters. For the first nine months of 2024, the cost was $1.62 per pound.

Kamoa-Kakula Sales: Sold 103,106 tonnes of payable copper in Q3 2024, generating $828 million in revenue and an operating profit of $392 million. Quarterly EBITDA was $470 million.

Cash Cost: The cash cost per pound of payable copper produced in Q3 2024 was $1.69, consistent with the year-to-date figure of $1.60. The cost was impacted by the ramp-up of Phase 3, including the use of lower-grade surface stockpiles and optimization of the concentrator circuit.

Adjusted EBITDA: Ivanhoe Mines’ Adjusted EBITDA was $160 million for Q3 2024, compared to $203 million for Q2 2024 and $152 million for Q3 2023.

Strong Balance Sheet: The company had $180 million in cash and cash equivalents as of September 30, 2024. Ivanhoe expects that current copper prices and cash flow from Kamoa-Kakula, along with project-level financing, will fund the remaining capital costs for Phase 3.

Friedland expressed optimism for the future, stating, “We expect 2025 to be a banner year as we deliver these significant production milestones, as well as advance our industry-leading exploration efforts in the Western Forelands, which continue to deliver some of the world’s most significant, tier-one copper discoveries.”

Ivanhoe Mines remains focused on achieving strong profit and free cash flow while continuing to advance their key projects and exploration initiatives in Southern Africa.