Base Metals

Africa at the cusp of a critical minerals boom

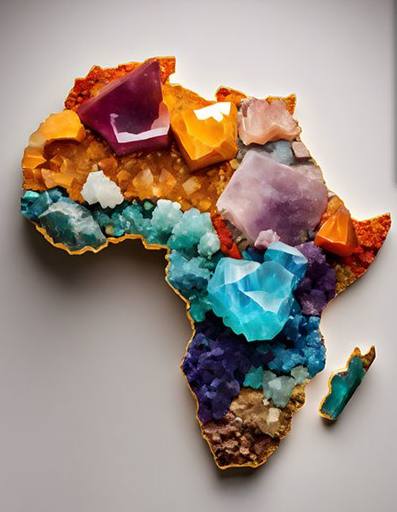

Africa has vast reserves of critical minerals, including cobalt, lithium, copper, rare earth elements, and other resources essential for our pursuit of cleaner power (predominantly solar, wind and storage) and electric (mainly new energy vehicles) technologies

The demand for these minerals is surging as the world increasingly shifts towards green energy and digitalization. However, to maximize the benefits of its rich mineral resources, Africa must enhance value addition within the continent, develop supporting infrastructure, and implement policy reforms that incentivize new refining capabilities.

This presents a strategic opportunity for Africa to significantly boost its economic growth through mineral development. It is an urgent course to consider as Global Data estimates that through to 2030, Africa’s annual crude oil and condensate production is forecast to decrease by a CAGR of 8.78%.

The key question is how Africa can ramp up mineral exploration and extraction and maximize value addition through local refining and manufacturing.

Reliable transportation infrastructure, including roads, railways and ports, is vital for efficiently moving raw materials and processed minerals.

Currently, China dominates the global mineral processing market, particularly in the production of lithium and cobalt. In 2019, the country imported approximately $10 billion worth of minerals from sub-Saharan Africa alone, underscoring the region’s reliance on foreign processing capabilities. While the Democratic Republic of Congo (DRC) dominates cobalt mining globally, 60% of cobalt processing occurs in China. In 2022, Zambia exported $6.6 billion in raw copper, most of which was sent to China.

Recent developments reported by ESI Africa showcase the aim to reverse this trend through an influx of infrastructure investments and policies that support domestic processing capabilities. Taking this a step further, some countries have introduced export bans on unprocessed critical minerals including Namibia, Ghana, Zimbabwe, and Malawi.

During a conference in 2023, Malawi’s Minister of Mining, Monica Chang’anamuno, spoke on how African countries are trying to catch the critical minerals commodity cycle on the upswing. According to the minister, Malawi is considering Zimbabwe’s ban on exporting unprocessed lithium because it doesn’t make sense to export minerals, only to import the finished products at great cost. “Once the minerals are gone, they’re gone forever,” she said.

Supporting infrastructure for extraction, processing and distribution

Developing robust infrastructure is crucial for efficiently extracting, processing, and distributing critical minerals and, ultimately, for value addition and economic growth.

Critical areas for infrastructure development include transport, energy, water and digital systems.

Transportation networks: Reliable transportation infrastructure, including roads, railways and ports, is vital for efficiently moving raw materials and processed minerals. Improving and expanding transportation networks can reduce logistics costs, enhance market access, and increase the competitiveness of African minerals in global markets.

This is already underway in some countries, such as the AfDB-approved $40 million loan to the Mozambique Rail and Port Authority (MRPA) to buy locomotive rolling stock. The project is expected to strengthen intra-African trade and regional integration by increasing capacity and the volume of goods transported from neighboring countries by the most efficient route

Then, the planned railway line connecting Africa’s Copperbelt to a port in Angola is expected to carry at least a million tonnes of minerals a year before the end of the decade.

Energy supply: Access to reliable and affordable energy is essential for mining and processing operations. Developing renewable energy sources, such as solar, wind and hydroelectric power, can provide a sustainable and cost-effective energy supply. Additionally, investment in grid infrastructure can ensure consistent power delivery to remote mining areas.

Developments include the 135MW Merak 1 solar plant, which will be operational by the end of 2024 and support African Rainbow Minerals’ operations in South Africa. In Zimbabwe, Zimasco plans to build a 100MW solar farm, to feed excess electricity to the national grid. In Zambia, First Quantum Minerals anticipates commissioning a 430MW solar plus wind project in 2026/27.

Also, a solar plant set to be operational in Namibia by the end of 2024 will inject energy into NamPower’s brand-new Eldorado substation. The energy will then be allocated under the Modified Single Buyer framework to B2Gold’s Otjikoto Mine, around 300km north of Windhoek.

Water management: Water is a critical resource for mining and processing activities. Implementing efficient water management systems, including recycling and treatment facilities, can mitigate environmental impacts and ensure sustainable water usage. Infrastructure investments in water supply and sanitation are also necessary to support mining communities.

Digital infrastructure: Advanced manufacturing and processing increasingly rely on digital technologies, including automation, data analytics, and the Internet of Things (IoT). Developing robust digital infrastructure, such as broadband connectivity and data centres, can enhance operational efficiency, improve safety, and foster innovation in the critical minerals sector.