Base Metals

Sanu Gold Announces $5 Million Private Placement Led by AngloGold Ashanti and Capital Limited

Sanu Gold Corporation (CSE: SANU) (OTCQB: SNGCF) ("Sanu Gold" or the "Company") is pleased to announce a non-brokered private placement (the "Placement" or the "Financing") of up to 100,000,000 common shares (each, a "Common Share") at a price of C$0.05 per Common Share for aggregate gross proceeds to the Company of up to C$5,000,000.

Two new Strategic Investors have indicated their intention to make lead subscriptions to the Placement:

- AngloGold Ashanti plc ("AngloGold Ashanti") has indicated its intention to participate for 33,400,000 Common Shares in the Financing for aggregate gross proceeds of C$1,670,000. AngloGold Ashanti's strategic investment will represent an approximate 14% ownership post-Financing. If completed, AngloGold Ashanti will be acquiring these common shares for investment purposes and may increase or decrease its interest in the Company in the future as market and other circumstances may dictate.

- Capital DI Limited, the investment subsidiary of Capital Limited ("Capital"), has indicated its intention to participate for 24,000,000 Common Shares in the Financing for aggregate gross proceeds of C$1,200,000. Capital's strategic investment will represent an approximate 10% ownership post-Financing.

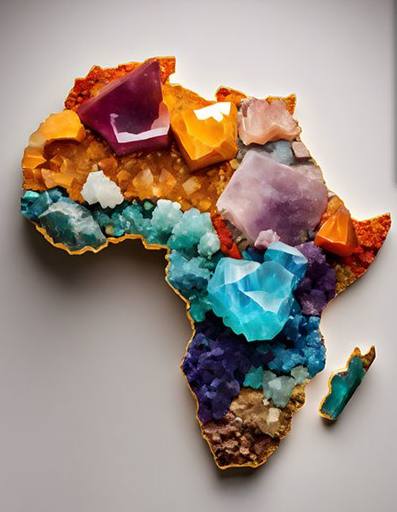

"Adding two, large, new Strategic Investors highlights the prospectivity and high-quality nature of the Company's assets in Guinea, West Africa. AngloGold Ashanti, a top-tier global gold miner, has been producing 200,000 to 300,000 Oz of Gold/year from its Siguiri mine in Guinea for the last 25 years. Capital is a rapidly expanding international drilling and mining services provider, with deep operational roots in West Africa and Guinea. Capital is supporting the mining industry in Guinea with investments, drilling and laboratory services. We look forward to working with both AngloGold Ashanti and Capital on unlocking some potential major discoveries on both the Diguifara and Daina permits with up to 10,000m drilling" commented Martin Pawlitschek, President and CEO of Sanu Gold.

The net proceeds of the Placement will be used to advance exploration, including ground geophysics and a 10,000m drilling program on the Company's Diguifara and Daina Gold Exploration Permits in Guinea, West Africa, the Company's other exploration permits in Guinea, West Africa and for general working capital purposes. The Placement is subject to regulatory approval and all securities issued pursuant to the Placement are subject to a four-month hold period under applicable Canadian securities laws.

The Company may pay finders' fees in connection with the Placement, as permitted by applicable securities laws and the rules of the Canadian Securities Exchange ("CSE"). Eventus Capital Corp. has been appointed as a finder in connection with the Placement. The Placement is subject to the Company's filing requirements with the CSE and the Company anticipates closing of the Placement as soon as practicable subject to receipt of all necessary regulatory approvals.

In connection with the anticipated closing of AngloGold Ashanti's strategic investment, the Company will enter into an investor rights agreement, whereby, subject to certain conditions, including time and ownership thresholds, AngloGold Ashanti will have certain rights, including the right to participate in future equity issuances to maintain its ownership in the Company, participation and top up rights, a right of first refusal on certain asset-level transactions for Diguifara, and the formation of a technical advisory committee focused on the Diguifara project.

Certain directors and/or officers of the Company may acquire securities under the Placement. Any such participation would be considered to be a "related party transaction" as defined under Multilateral Instrument 61-101 ("MI 61-101"). The Placement will be exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 as neither the fair market value of any Common Shares issued to or the consideration paid by such persons will exceed 25% of the Company's market capitalization.