Distribution

Shell/Renaissance deal setback symptom of Nigeria’s oil woes

A chief economist at Shell once described Nigeria as the “jewel in the crown” of the oil major’s empire. Yet in recent years, the jewel has lost its lustre.

Early this year, Shell, which has been pumping oil in Nigeria for nearly seven decades, agreed to sell its onshore subsidiary to a consortium of mostly local companies.

Gbenga Komolafe, chief executive of the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), surprised many in the industry on October 21 by saying the sale to a local consortium, Renaissance Africa Energy, was blocked because the transaction did “not scale [the] regulatory test.”

While he did not provide details of the regulator’s reasoning, experts said this development, while disappointing for some, offers a stark reminder of the complex issues hindering Nigeria’s potential to maximise its oil wealth.

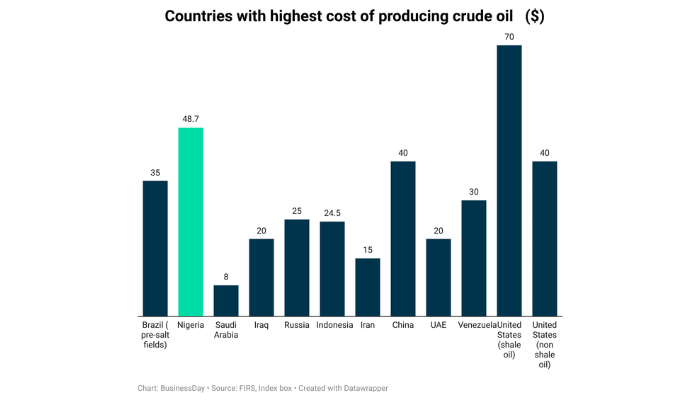

“Nigeria has had well-established problems in policy in the oil sector, and the foreign exchange policy concerns have put constraints on investments. That’s probably partially why you have seen the majors pulling out, and disinvesting to some extent,” Andrew Matheny, senior economist with Goldman Sachs Matheny added, “It explains a significant portion of the decline in oil production in recent years.”

Twenty-one years ago, Shell Petroleum Development Company of Nigeria (SPDC) share of production was as high as over one million barrels of oil per day (bpd) in Nigeria

This fell to 290,000 bpd in 2023, which the company blamed on sabotage and theft in the Niger Delta, its annual reports showed.

Analysts said basic economics should ordinarily nudge Nigeria towards a deal Shell said it has structured to maintain SPDC operational capabilities to support the SPDC Joint Venture (SPDC JV).

Data sourced from Shell Nigeria’s Briefing Notes 2023 showed that SPDC JV’s operating assets include: 250 producing oil wells (189 West assets and 61 East assets), 37 producing gas wells (4 West assets and 33 East assets), four gas plants, and two onshore oil export terminals.

As part of the transition, SPDC’s employees will remain with the company under the new ownership.

“It is time we tried a more viable approach, which is to allow the independents with trackable records to play a significant role in Nigeria’s oil and gas sector,” a business leader in the upstream sector said during an interview in his Lagos office.